Unlock Innovation with Custom AI Agents

Our AI Factory is the ultimate resource for innovative solutions tailored to banking, insurance, and private equity challenges.

What is Agentic AI?

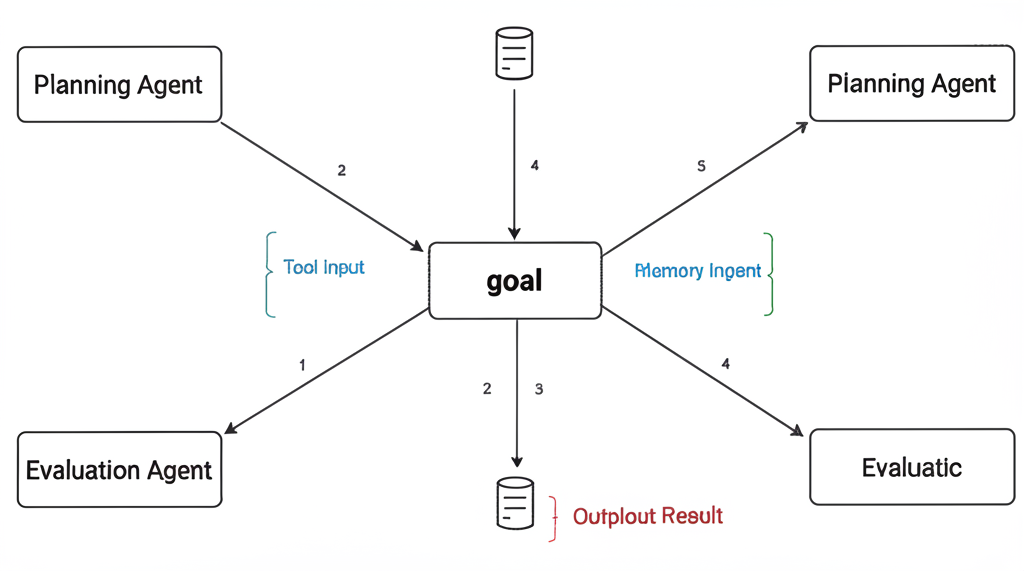

Unlike traditional AI systems designed to assist with specific, predefined tasks, agentic AI systems can reason, plan, and act autonomously within specified parameters. These systems can integrate various tools, adapt to changing contexts, and iterate on their own outputs.

Agentic AI has the potential to redefine the banking landscape, transforming operations and elevating customer engagement to unprecedented levels. Our platform enables you to create and deploy custom AI agents for your specific business needs.

Learn More About Agentic AI

Industry Filters

Department Filters

Our Top AI Agents

Investment Insights Agent

Personalizes investment recommendations, dynamic product suggestions, and market analysis based on client profiles and market data.

Learn more →

Due Diligence Agent

Suggests potential questions Due Diligence (DD) team members might ask during evaluations and automates document analysis.

Learn more →

KYC Agent

Extracts all KYC related information from client interactions and drafts a structured report for compliance review.

Learn more →

Compliance Monitor

Continuously monitors transactions and communications for regulatory compliance issues, flagging potential risks.

Learn more →

Meeting Assistant

Joins meetings, records and transcribes conversations, extracts action items, and sends follow-up summaries.

Learn more →

Document Analyzer

Processes financial documents, extracts key information, and generates summaries and insights for decision-making.

Learn more →Agentic AI Implementation Techniques

Our platform supports advanced techniques for implementing agentic AI effectively in your financial institution.

Prompt Chaining

Decompose complex tasks into a sequence of steps, where each LLM call builds on the output of the previous one. This increases accuracy by simplifying each step and creating a logical workflow.

Example:

Generate marketing proposal → Validate against compliance → Translate into multiple languages

Parallelization

Split tasks into independent subtasks that are executed simultaneously. This significantly reduces processing time and can provide diverse perspectives or improved confidence through consensus.

Example:

Analyze client portfolio + Generate market insights → Combine into investment recommendation

Tool Integration

Connect AI agents with external tools and systems to extend their capabilities. Agents can use these tools to access data, perform calculations, or take actions in other systems, creating a more powerful and versatile AI solution.

Example:

Retrieve client data from CRM → Generate investment report → Schedule follow-up meeting

Feedback Loops

Implement mechanisms for agents to evaluate their own outputs and refine them based on feedback. This creates a self-improving system that learns from experience and adapts to changing requirements.

Example:

Generate compliance report → Evaluate against regulatory checklist → Refine and improve

Real-World Applications

Discover how financial institutions are leveraging our AI agents to transform their operations and client experiences.

Knowledge Management at Pictet Group

Pictet Group deployed an internal chatbot that answers questions about the Group's history, HR processes, people directory, group directives and policies, and IT-related questions using RAG technology.

Corporate Language Translation at Julius Bär

Julius Bär uses GenAI to support the translation of corporate content, ensuring communication aligns with the bank's tone and terminology through a fine-tuned language model.

Service Quality Enhancement at SIX

SIX uses generative AI to transcribe calls, analyze content, and identify problematic interactions, providing agents with targeted training recommendations and identifying business opportunities.

AI Empowerment Program at Raiffeisen

Raiffeisen Bank launched a comprehensive AI enablement strategy with local AI champions and multiple learning channels, driving a 50% increase in AI tool adoption among staff.

Ready to Build Your Custom AI Solution?

Our team of AI experts will work with you to develop tailored solutions for your specific business challenges.

Schedule a Consultation